National Identification System and Digital Financial System

Spartan Solution’s Team: Our team (Spartan Solutions of Virginia Beach, VA.; DevDigital of Nashville, TN.; Newport Board Group of Atlanta, GA.; and Consult Hyperion of London, U.K. and New York, NY.) has proven experience providing secure identity and digital financial system services and advising governments and various industries globally. Our secure identity and digital financial system developer, Consult Hyperion, has advised the International Monetary Fund and World Bank on technology, business models, regulatory best practices globally; and designed and delivered services aimed at building Identity and Digital Financial Systems to drive financial inclusion across a country's population.

Public Services Card (PSC): The team assisted in the launch of a smart card with an identity framework which facilitated the integration of the PSC into their the countries government services. This facilitated citizen's access to federal government distribution of benefit payments and the number of individual's claiming benefit payments fell, as many fraudulent claims were shut down.

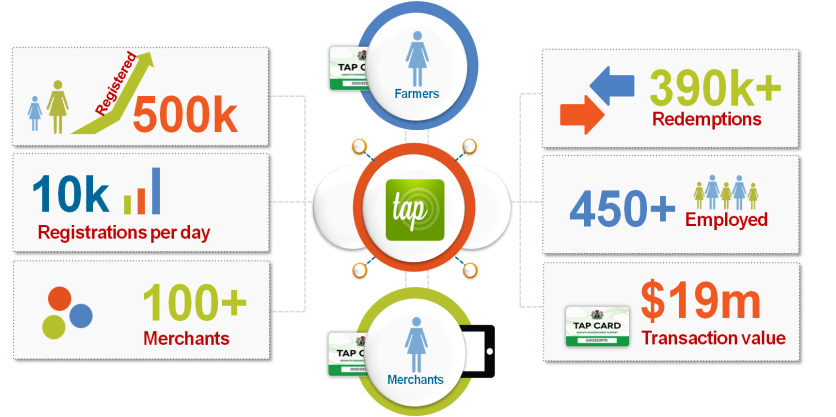

Growth Enhancement Scheme: Touch and Pay (GES -TAP) : The team assisted in delivering a service that was used to register and distribute e-vouchers to more than 500,000 subsistence farmers over a 3-month period. The e-vouchers provided the farmers with subsidies in excess of $19,000,000 USD for fertilizer, seeds and other agricultural inputs. The Figure (1) displays the process used from registration to transaction.

Figure (1): Registration to Transaction Process

The service collects information about farmers and their merchants in areas with unreliable or no communication or electricity networks; issues them a transactional identity card; uploads the information to a cloud-based database; assigns and distributes e-vouchers to the farmers; manages their redemption in registered merchants by the farmers in exchange for subsidized goods or services; transmits information about the e-vouchers redeemed to the cloud-based database; and periodically delivers transaction reports detailing the funds to be repaid to the merchant.

Smartcard and Mobile Based Retail Payment Services: Additionally, the team has help international banks (Barclays Bank, Lloyds, Royal Bank of Canada), the international payment card companies (American Express, Discover, MasterCard, Visa) and the domestic payment card companies in Australia, Canada and India to design and implement smartcard and mobile based retail payment services at least one of which will be in your wallet or phone. Figure (2) provides an example of a Smart Phone being used for an M-PESA transaction.

Figure (2): Smartcard and Mobile Based Retail Payment Services

The Right Strategy for the Right Client: As displayed in Figure (3) our team's knowledge, gained from delivering such projects across the globe, means that our clients can be sure that their chosen strategies are informed, pragmatic and appropriate to local circumstances. We work with our clients throughout the entirety of the business cycle (as appropriate) to help them face various technical, operational and regulatory challenges. We are fully equipped to design, build, deploy, operate and support scalable Sovereign National Identity System and Digital Financial System Services.